BNM Interim Measures on Medical Takaful

We are fully committed to support BNM’s interim measures on medical Takaful. Kindly take note that this is applicable to certificate holders impacted by medical revision effective 1 October 2024 onwards.

What are the Interim Measures?

-

Gradual Adjustments:

For affected certificate holders, contribution adjustments will be staggered over a minimum of three years in 2024, 2025 and 2026. This means at least 80% of certificate holders will see yearly contribution adjustments of less than 10% annually.

-

Senior Support:

There will be a one-year pause on contribution adjustment due to medical claims inflation for those aged 60 and above, covered under the minimum plan.

-

Certificate Reinstatement:

Customers who have surrendered or lapsed their certificate from January 2024 to February 2025, due to medical revision, will be eligible for reinstatement without underwriting.

This option is available upon request from 15 January to 31 August 2025.

-

Alternative Plans:

To supplement the interim measures, Takaful operators must develop an appropriate alternative product within the next one year that carefully considers the long-term affordability of medical coverage.

How do I find out about my new contribution and/or Tabarru` deduction?

You will receive updated notification pack detailing your new contribution and/or Tabarru` deduction depending on your certificate anniversary date. Please refer to timing below:

|

|

*Only applies to HE/HE+/HP. |

Where do I find my Certificate Anniversary Date?

The Certificate Anniversary Date is the date each year that marks the anniversary of when your certificate was first issued .

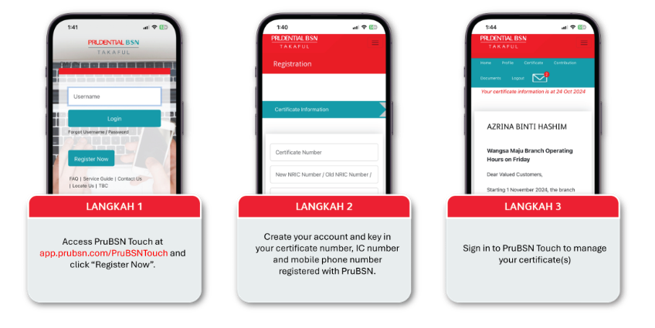

Log on to PruBSN Touch >> Go to Certificate Tab >> Click on the Certificate Number >> Read Inception Date

How do I create my PruBSN Touch account?

Reminder: You can access your Medical Revision pack through PruBSN Touch. If you have registered your email address with PruBSN, you can also view the Medical Revision pack in your email. |

For further assistance, certificate holders may reach out to our dedicated hotline at 03-2742 4060 (Monday to Friday, from 8.30am to 5.15pm), except on Public Holidays or customer@prubsn.com.my

References:

Link to BNM’s press statement: Interim measures to assist policyholders and to promote continued access to suitable medical and health insurance/takaful products - Bank Negara Malaysia

Link to BNM’s information on the interim measures: Interim Measures to Promote Continued Access to MHIT Products - Bank Negara Malaysia

Link to MTA's press statement: Insurance and Takaful Industry Introduces Interim Measures for Policyholders/Takaful Participants Impacted by Premium/Contribution Repricing

Link to MTAS’s FAQs: FAQ-Interim-Relief-Measures-20Dec2024-FinalVersion.pdf

Frequently Asked Questions

1. Is my certificate impacted by these interim measures?

The interim measures are applicable to participants impacted by the medical revision effective as per the table below.

|

Medical Revision Effective Date |

PruBSN Medical Plans |

Receive updated notification pack by end of March 2025 |

Receive notification pack 30-90 days before the Effective Date |

|

From 1 Oct 2024 onwards |

HealthEnrich+ HealthEnrich HealthProtector |

Certificate Anniversaries between Oct 2024 and Mar 2025 |

Certificate Anniversaries between Apr 2025 and Sep 2025 |

|

From 1 Nov 2024 onwards |

Medic Protector |

Certificate Anniversaries between Nov 2024 and Mar 2025 |

Certificate Anniversaries between Apr 2025 and Oct 2025 |

|

From 1 Dec 2024 onwards |

Takaful Health2 Takaful Health Major Medical Cover2 Major Medical Cover |

Certificate Anniversaries between Dec 2024 and May 2025 |

Certificate Anniversaries between Jun 2025 and Nov 2025 |

|

The following plans are excluded from this current medical revision and are not impacted by BNM interim measures:

|

|||

|

|

|||

2. My contribution was adjusted between 1 January 2024 and 30 September 2024. Am I eligible under this interim measure?

BNM’s interim measures are only applicable to participants impacted by medical revision effective 1 October 2024 onwards. You can refer to the table in Q1 for details on which certificates are eligible.

3. What happens if I have already paid the new contribution before these measures take effect? Will I get refunded and when?

If you are eligible under the interim measures, you will get a refund for the contributions you have paid.

4. What is staggered/spreading out of contribution increases?

Staggered or spreading out of contribution increases is a flexibility offered to adjust the increase in contribution to a lower amount, distributed over a period of minimum 3 (depending on your medical plan). This is only a temporary relief measure to assist participants in managing their contribution during this interim period. We will be reaching out to the affected policyholders with more information.

5. Will my benefits be affected by this new measure?

No, your medical benefits, including coverage limits, remain unchanged.

6. How will these measures affect senior citizens aged 60 and above?

For customers aged 60 years old and above who are covered under the minimum plan, there will be a one-year deferment of the incremental contribution and/or Tabarru` deduction (i.e., the repriced amount). This means there will be no repricing for one year for eligible participants, please refer to the table in Q1 for more details.

Please reach out to your PruBSN Takaful Consultant or Bank Representative to find out more on your plan.

7. I have not made a claim, why am I still being repriced?

Takaful is based on the concept of mutual assistance among the participants. Tabarru` deductions are pooled into the Tabarru` Fund to pay for future claims. To keep the fund sustainable amid increasing healthcare costs, adjustments to these deductions are needed. These revisions will impact all similar medical plans, regardless of individual claims history. This helps ensure that the fund can cover future claims for all participants.

8. What are the other options available for me?

We offer several flexible options, including:

|

Options |

Details |

|

Change Co-Payment Options |

Lower your contribution by converting to other co-payment options (e.g., SmartSaver300 or SmartSaver1000) if applicable to your medical plan. |

|

Reduced Coverage Plan |

Revise your room & board (R&B) plan to a lower level (if applicable). Do ensure it still meets your medical protection needs. |

|

Switch Plan (if available) |

Consider switching to the latest available medical plan under the same certificate which meets your protection needs and affordability. |

|

Review Current Benefits |

Assess your certificate’s benefits to align with your current protection needs and affordability. Be aware that changes impact your protection. |

|

Adjust Target Coverage Term (for Investment-Linked certificates only) |

Shorten the target coverage term to match your needs and affordability. Note that this may affect the certificate’s ability to sustain Tabarru` deduction until the chosen expiry age. |

You may also contact your dedicated Wealth Planner / Takaful Consultant / Bank Representative for further advice and recommendations.

9. I surrendered/lapsed my certificate due to repricing. Can I reinstate/revive my certificate under these interim measures?

Where applicable, participants who have surrendered or lapsed their certificates between 1 Jan 2024 to 28 Feb 2025 due to medical revision are eligible for reinstatement or revival without underwriting. Waiting period will be waived for this special reinstatement request.

This option is available upon request from 15 Jan to 31 Aug 2025 only.

For lapsed certificate:

Please submit the Revival Application Form (to fill up Certificate Details and Part F only) and get in touch with your PruBSN Takaful Consultant or visit the nearest PruBSN Branches.

For Surrendered certificate:

Please submit your written requests to your PruBSN Takaful Consultant or visit the nearest PruBSN Branches.

Kindly ensure all payments are up to date.

10. What is the turnaround time for reinstatement?

Please allow us up to 10 working days to process your reinstatement request. Once approved, you will receive a notification letter from us.

11. How much am I required to pay to reinstate/revive my certificate?

There is no processing fee involved for reinstatement of your certificate. However, you are required to catch up and pay any outstanding contributions from date of surrender/lapsed of your certificate. For reinstatement, you are required to pay back the surrender value as usual.

Once your certificate has been reinstated, the new staggered contribution charges apply from 1 April 2025.

12. Once I reinstate my certificate, will my contribution remain the same as before?

Depending on the certificate anniversary and plan type, the contribution based on staggered medical revision will apply.

13. Why does the increase in your new contribution and/or Tabarru' deduction exceed the 10% mentioned in the interim measures?

Your new contribution and/or Tabarru' deduction are determined based on risk factors. These may include age, gender and medical plan type. We review our overall customer base that you belong to and these specific rating factors to determine how much your new contribution and/or Tabarru' deduction will increase, which may exceed 10% for a certain year.

14. Can I choose a different staggered amount to pay a different contribution amount?

We encourage you to pay your new contribution amount specified in the Medical Revision Notification Letters to ensure your medical coverage continues. If you would like to explore other options to manage your contribution, please refer to Q8.

15. How sustainable are these interim measures and how will they affect my contribution and/or Tabarru' deduction in the long run?

The BNM interim measures were introduced to help ease the immediate financial impact and ensure long-term protection.

However, the underlying issues driving medical cost inflation will require broader health reforms and collaboration among various stakeholders. We are committed to helping our customers by providing accessible, affordable and effective healthcare