Understand the Basics of Takaful

More info here

Common questions

about Takaful

1. What is takaful?

The term takaful is derived from an Arabic root word “kafala” which means responsibility, joint guarantee or guaranteeing each other.

Islamic Financial Services Act (IFSA) 2013 has defined takaful as an arrangement based on mutual assistance under which takaful participants agree to contribute to a common fund providing for mutual financial benefits payable to the takaful participants or their beneficiaries on the occurrence of pre-agreed events.

2. How mutual assistance applies in takaful?

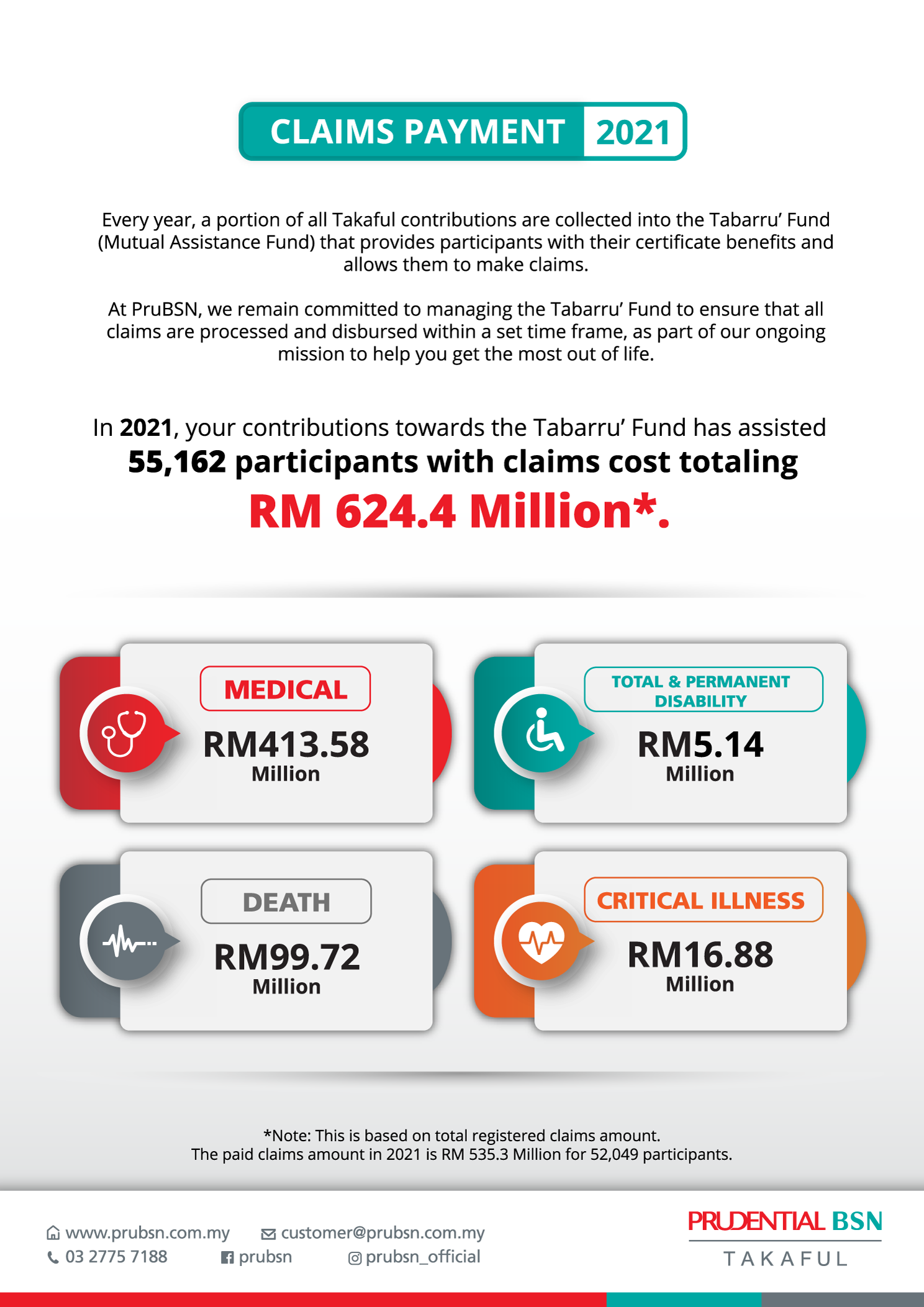

Mutual assistance in takaful refers to a contractual relationship among the participants contributing into the Tabarru` Fund. It applies when a participant of takaful agrees to participate in a takaful plan together with all the other participants with the intention is to help one another in case of need.

The Tabarru`at (charitable) contribution that the participant make will be pooled into the Tabarru` Fund together with the contribution of other participants to provide for mutual financial benefits payable to all the eligible takaful participants or their beneficiaries on the occurrence of pre-agreed events based on the agreed takaful benefit under the plan.

3. What are the aspects of mutuality embodied in takaful?

There are three aspects of mutuality embodied in takaful, namely mutual cooperation/assistance, mutual responsibility and mutual protection from losses. takaful is a system whereby participants contribute to Tabarru` Funds and intend to jointly guarantee each other, i.e., to compensate any of the participants who are inflicted with a specific risk. The focus at the point of participation should be the intention to contribute to the Tabarru` fund in line with the principles of mutual assistance and shared responsibilities among the members.

4. How does it work?

The participant does not only seek protection for himself but also jointly cooperate with other takaful participants to mutually contribute to one another in case of misfortune event.

Relationship between the participants and takaful operator is commonly governed by the contract of Wakalah (agency) where takaful operator is appointed by the participants to manage the plan and invest the funds in return of pre-agreed fees. It is a commercial business (Takaful Tijari) with clear in terms of roles and accountability. As a manager, Takaful Operator carries the fiduciary duty to ensure the management of the business is in accordance with Shariah principles, legal and as well as regulatory requirements.

5. How much should I cover?

It depends on your financial needs and affordability. The aim is to reduce your family's and your financial burden if an unfortunate event happens to you. You may use our Need Analysis to gauge the coverage you need based on your affordability.

6. What are the important considerations in participating in a family takaful plan?

Participating in a family takaful plan is a long-term commitment. It is important that you make a point to assess what you need and what you can afford. The factors you want to consider include the following:

Your Needs

Your selection for a term plan must be a result of your own needs analysis. You should prepare a statement of all assets and liabilities, future goals, etc. and then zoom in on a sum that you would like to be covered for.

Your Risks or Obligations

While all family takaful plans cover death, some plans cover more specific risks, for example the early onset of a critical illness, accidental death and partial disability. Liabilities like debts and financing need to be paid over some period of time. Ideally, the term of your certificate should incorporate this time frame. For example, if your home financing will require 15 years to be settled, then the term should continue at least 15 years.

Your Dependents and Commitments

If your dependents have a few years before being financially independent, that duration can be the duration of your term. Landmark events like a wedding or a settled career should be appropriately within the term duration so as to allow your family to manage the financial uncertainties.

Your Financial Goals

They can be as specific as legacy provision for your children or paying off your mortgage. These goals should have exact time frames.

Your Desired Protection Level

This is generally based on numerous factors, some of which are:

-

how many dependents you have (e.g. retired parents, spouse, kids)

-

your outstanding long-term financial obligations (e.g. home financing, education fund)

-

your current lifestyle / standard of living

-

your current savings and investment assets

-

projected cost of expenses in the future based on currency valuation and inflation (e.g. an education degree at a private university today can cost 50% more years down the road)

Your Budget or Affordability

This is the amount that you can set aside for family Takaful after deduction of expenditures, commitments and savings. A term Takaful plan, which covers a particular number of years, such as our Lindungi Plan is a relatively cheaper alternative for individuals who are just starting out in life or on a tight budget. While you may also wish to maintain your loved ones’ current lifestyle, you do not need to target to provide this if you find that the contributions are beyond your budget. If you are unable to continue with paying the contributions on time, your takaful certificate may lapse or be terminated.

7. What must I be aware of as I sign up for a family takaful plan?

Understand the Product Well

Ensure that you read and understand all the product-related documents such as Product Illustration and Product Disclosure Sheet before committing to participate in a family Takaful plan.

Disclose Required Information

Takaful operators have put in place an underwriting process to determine what sort of risk you are to the takaful company and for the company to decide whether or not to accept the risk. The risk of death or a critical illness is determined by several factors such as age, gender, lifestyle, personal and medical history, profession etc.

8. What are the Shariah concepts applicable?

- Ta`awun - An arrangement to help one another on the basis of mutual assistance. Takaful is premised on the concept of Ta`awun as defined under the Islamic Financial Services Act 2013 which states that takaful is an arrangement based on mutual assistance under which takaful participants agree to contribute to a common fund providing for mutual financial benefits payable to the takaful participants or their beneficiaries on the occurrence of pre-agreed events. In light of the foregoing, the contributions that are placed and pooled together into a common fund i.e. Tabarru` fund (a fund that is collectively owned by the participants) is Tabarru`at (charitable) in nature.

- Wakalah bi al-ujrah: An arrangement appointing us to manage the overall services provided under the plan. PruBSN will deduct a certain percentage of the contribution as Wakalah Charge in return for these services. In addition to the Wakalah Charges, PruBSN is entitled to performance fee on the distributable surplus from the Tabarru` fund.

-

Mudarabah – An arrangement allowing us to invest your funds from ISA where any profit from such investments will be shared between you and PruBSN according to a fixed profit sharing ratio. The principal as well as the investment returns are not guaranteed.

-

Hibah - a gift without any consideration. Under this plan, PruBSN will provide EduAchieve Bonus as Hibah payable from the shareholder’s fund. The Hibah is subject to fulfilment of the conditions as stated in the certificate document.

-

Sadaqah - denotes a voluntary offering to benefit another. This donation or charity arrangement is applicable for the Ihsan rider where a defined portion of your contribution will be channeled into PruBSN Jariyah Fund to fund the Microtakaful plan contribution of the recipient who is the poor and the hardcore poor.

9. Claims