Vital Takaful Tips:

How Comprehensive is Your Cancer Coverage?

Cancer is one of the leading causes of death worldwide.

In 2020, 48,639 new cancer cases were registered in Malaysia, which included 29,530 cancer-related deaths. There is a significant increase in new cancer cases compared to the years 2012-2016. There were 115,238 new cases or an average of 28,809 per year during the four-year period. The Malaysian National Cancer Registry Report 2007-2011 estimates that one out of every ten men, and one out of every nine women has a lifetime risk of developing cancer.

Many Malaysians are aware of these alarming statistics and are actively taking proactive measures to keep cancer at bay by leading healthier lifestyles. Although a healthy lifestyle can significantly reduce your risk of developing cancer, unfortunately, exercising and eating healthily does not necessarily guarantee you a cancer-free life.

It is important to financially prepare yourself if any unpredictable scenario occurs, subscribing to a cancer-specific insurance policy or participating in a takaful plan is the best way to relieve you from any future financial difficulties. However, there are various takaful plans available on the market that cater to different coverage requirements, while being shariah-compliant. It may be overwhelming trying to decide which takaful plan is the right one for you. If you are an existing takaful subscriber, it is important to find out how much you are protected by your current certificate, especially in regard to cancer-specific illnesses.

Customised comprehensive protection with PruBSN AnugerahPlus

PruBSN AnugerahPlus is a customisable Shariah-compliant takaful solution that can be tailored to provide you with comprehensive cancer protection. With a monthly contribution that starts as low as RM50, this certificate includes a minimum death or permanent disability coverage benefit of RM10,000, as well as an EduAchieve Bonus. These low contribution rates ensure that even those with less expendable income can afford to get themselves protected if cancer were to strike.

To provide you with flexible, customisable coverage, PruBSN AnugerahPlus includes several riders that can be attached to your plan. For the best in cancer coverage, however, we recommend you include the Medical and Critical Illness riders to your certificate.

As an overview, Medical riders cover hospitalisation expenses while Critical Illness riders replace loss of income if you are diagnosed with a critical illness such as cancer while supporting other related expenses as well. Let’s go into more detail below.

Cover your hospital expenses with Medic Protector

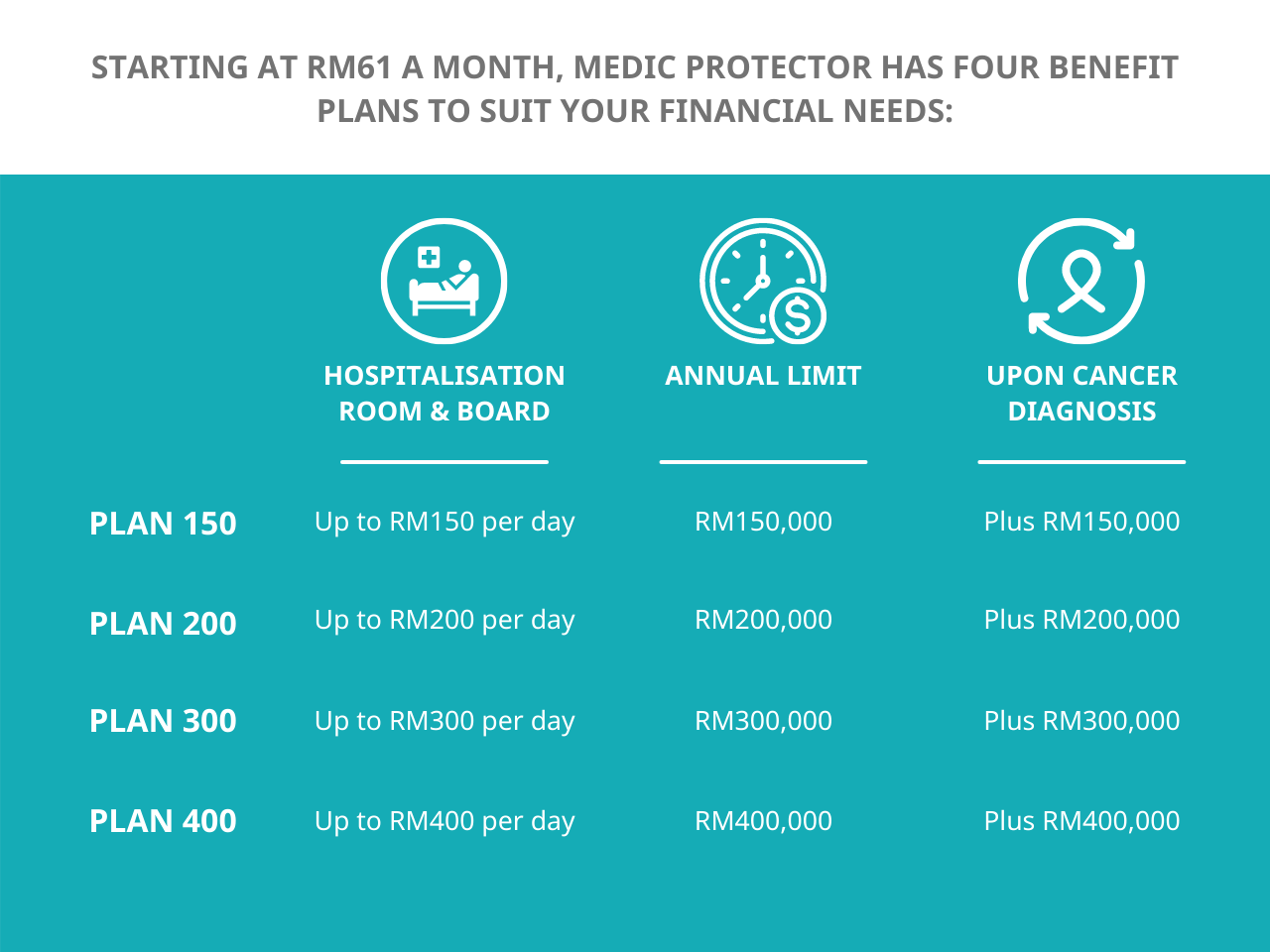

Hospital bills can get expensive, especially if you require surgery and must be admitted. PruBSN Medic Protector is a medical card that provides you financial support with a lifetime’s worth of medical care and treatments of up to RM400,000 annually. If you are diagnosed with cancer, Medic Protector will double your annual coverage, so you can focus on healing and not have to worry about finding the money to pay for your treatments.

While your cancer diagnosis doubles up your annual coverage, the additional amount can be used to treat other illnesses.

Medic Protector includes an additional lifetime limit for outpatient cancer treatment that’s separate from your plan’s annual limit, as well as a daily cash allowance for chemotherapy and radiotherapy treatments.

Besides these cancer-specific benefits, subscribing to Medic Protector pays for all your eligible hospitalisation needs.

Increase your annual limit by RM1,000,000 with Medic Booster

By just topping up RM14 onwards to your monthly contribution, you can increase your annual limit by an additional RM1,000,000 through Medic Booster. Available only with the Medic Protector rider, this addition to your overall AnugerahPlus certificate can give you greater peace of mind and provide you with the treatment you need. Furthermore, Medic Booster will also double your lifetime limit for outpatient cancer treatments.

Receive a lump sum amount with Crisis Shield and Crisis Protector

Crisis Shield and Crisis Protector are two Critical Illness riders that will give you a lump sum payment of minimum RM10,000 upon the diagnosis of any of the 43 covered critical illnesses, including cancer. This provides you with some financial support for your immediate needs during the early days of your diagnosis and treatments.

The benefits from these riders can be used to help support alternative treatments or treatments that are not covered under your medical plan, or as an income replacement if you are unable to work due to cancer or a critical illness.

Cancer-specific lump sum payment with Cancer Protector

Give yourself additional protection with Cancer Protector. With a coverage of RM50,000 up to RM2,000,000, you can claim 5% of the sum covered within the very first year of your certificate upon the diagnosis of early-stage cancer (or 10% from the second year onwards), while the balance can be claimed if your cancer progresses to late-stage cancer. This amount can be used to pay for your treatments, as income replacement should you need to take an extended leave or are unable to continue working, or for any other related expenses.

Cancer is worrying, but we can help you be prepared for any eventuality with PruBSN AnugerahPlus. With an expiry date of 100 years old, you can start your cancer protection from anywhere between 1 to 70 years of age. This is especially useful if you have a family history of cancer, so you can start protecting yourself and your children while they are still young.

Talk to one of our Takaful Agents today to find out more about PruBSN AnugerahPlus, because if that diagnosis comes back malignant, all we want you to do is fight the good fight and focus on getting better. Let us help you take care of the medical bills.

[i] Malaysia Fact Sheets by World Health Organization, International Agency for Research on Cancer,

[ii] Cancer Cases Rise in Malaysia, Chinese Most Prone by CodeBlue, 03 January 2020,

[iii] World Cancer Day 2019 Factsheet for Healthcare Providers by Disease Control Division Ministry of Health Malaysia

[iv] Specifically via the Medic Protector - Level Contribution option

Did you know?

As a PruBSN takaful participant, our Medical, Critical Illness and Contributor riders will provide you with medical benefits for treatments, lump sum payments for income replacement, as well as contribution payment assistance to ensure you receive uninterrupted covered from your takaful plan if you are diagnosed with cancer or a critical illness.