Five Passive Income Ideas for the Digitally Savvy

Earning a passive income used to be an activity reserved for those who had significant liquid finances they could use to make even more money.

Thanks to the global online marketplace and the digitalisation of so many aspects of our lives, including our finances, the scope and methods for earning a passive income have significantly broadened and are more achievable than before.

Today, anyone can earn a passive income regardless of their financial status. A passive income is a great way to generate extra money to supplement your current income, build your savings and emergency funds, work towards an early retirement, or find financial independence especially if you are keen to live the own-boss lifestyle. Earning a passive income also diversifies your financial portfolio and provides additional financial security if the event your daily 9-5 job falls through.

Benefits of Passive Income

You must be wondering how passive income benefits you in life. Here are a few benefits passive income can bring to your life:

Reduces anxiety and stress

Passive income helps provide financial security and eases your concern about your inability to pay bills. It provides financial support and future stability, which results in the financial momentum to oversee your well-being, your time, and your assets.

Provides financial stability

Passive income provides the financial stability that may help you go through an earlier or more comfortable retirement, allowing time for financial growth. If you focus on growing your wealth rather than merely maintaining your current life, financial clarity can be provided and it helps you reach your monetary goals faster.

Five ways to earn a passive income

While earning a passive income means making money with minimum effort, it is incorrect to assume you need to do nothing to start earning. Earning a passive income requires at least one of two things:

-

A lot of money, or

-

A lot of time and effort.

Earning a passive income is a long-term plan – not everyone can become a YouTube sensation overnight. For most of us, earning a solid passive income will require years, maybe even decades, of patience. This is why it’s good to get a head start so you can earn even more over time.

1. Put your money in dividend-paying funds

With annual reported dividends around 5-7% per annum, this is quite a safe and secure way to earn a passive income over time and does not require large amounts of money to start. In Malaysia, two of the most well-known dividend-paying funds are Amanah Saham Nasional Berhad (ASNB) and Employee’s Provident Fund (EPF, also known as Kumpulan Wang Simpanan Pekerja ‘KWSP’).

ASNB requires a minimum investment of only RM10 to start earning dividends. Imagine building this amount over time, especially if your account was started from the day you were born.

EPF is a form of enforced savings to help employed Malaysians save for their retirement. Withdrawals can only be made upon reaching retirement age or if you meet very specific requirements. Even then, there is a ceiling to how much can be withdrawn.

Private dividend-paying funds are also available if you would like to put your extra income elsewhere. Do your research to ensure they meet your needs and requirements and will not risk your hard-earned money.

2. Small investments, big impact

Investing in the stock market can make sizeable amounts of money if you get it right. However, it can be daunting if you’re new to the game and not to mention the possible risk of losing it all. Thanks to technology and innovation, it is now possible to start investing with as little as RM1, although, of course, the more money you put in, the more your expected returns over time.

There are 2 types of investments that are popular today - robo-advisors and P2P (peer to peer). Robo-advisors play the investment game for you by using artificial intelligence to analyse trends, performance and predictions with a typically low fee taken off your earnings – if you don’t make money, they won’t either.

P2P lending collects funds from several investors and loans them to businesses, who will then repay their borrowings with interest. Besides earning a passive income, your investment also helps spur local economic growth and assists start-ups and SME’s.

Both these platforms come with varying risks. If you are keen to explore them, do your research and select a reputable platform. They must be licensed with and regulated by your local monetary and security bodies.

If you have insurance or Takaful, let them do double duty by selecting one that is investment-linked. These investments tend to have smaller returns, but since you’re already paying, you might as well let it earn a little extra on the side.

3. Earn an income online through affiliate advertising

Earning a passive income through affiliate advertising does not require a lot of money but it does take time and effort.

Income is typically earned by clicks an advertisement receives on your platform – the more clicks it receives, the more you will earn. Some of the more popular affiliate programs include Google AdSense, Amazon Affiliates, eBay Partner Network, Rakuten Marketing, and many more.

Creating a website is the best place to start earning through affiliate advertising as no minimum number of readers, viewers or subscribers are necessary. Of course, the more you build your audience, the more clicks you will get, earning you a better income.

YouTube, on the other hand, has requirements before you can qualify for a YouTube partner account and start monetising your videos – you need at least 1000 subscribers with 4000 hours of watch time in the last 12 months, while ensuring you stick to YouTube’s guidelines and policies. Becoming a YouTube success requires tons of effort and creativity. However, the potential passive income is lucrative though and definitely worth the effort.

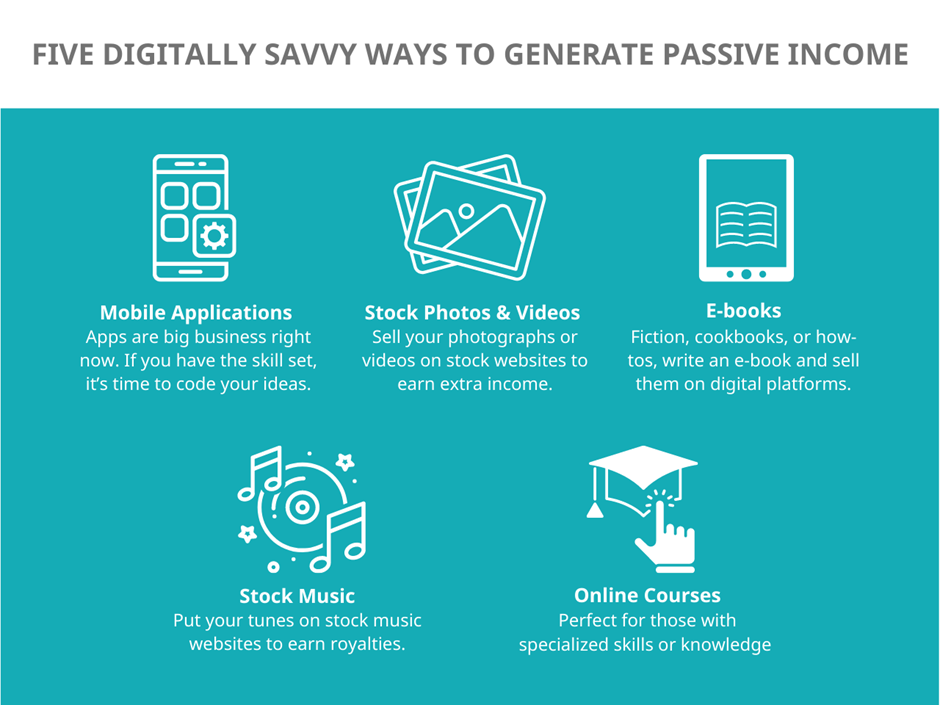

4. Create a digital product

A digital world requires digital content and there’s a variety of products you can create and sell to a global audience. If you have a hobby, skill or specialized knowledge, sell your digital product to the right audience and you will be surprised with the money you can make!

There are many digital products you can create and sell online requiring minimal financial input. Start with a list of your skills and interests and explore the possibilities.

5. Start selling online

Selling online can be a lucrative way of earning a passive income, and you can decide how involved you want to be with the entire process.

Usually, selling online means requiring an inventory of products and a system to ship them out once orders are made. However, if you sell digital products or focus on drop-shipping, your hands-on involvement is significantly less. In fact, all you need to do is compile the products you want to sell on your website, accept the orders and provide the relevant instructions to your shopper or supplier.

E-commerce platforms such as Amazon, Lazada and Shopee have made it even easier to become an online seller. Just sign-up for a seller account, upload your product information, set your selling price and wait for the orders to come in, all for a very affordable commission on sales.

Earning a passive income is a very real and achievable dream. Whether you choose to make your money or time work, you should definitely try it out. Who knows, you might end up building yourself a nice little nest egg at the end of a not-so-long-and-hardworking day.