PruBSN

WarisanGold

Reasons to consider PruBSN WarisanGold

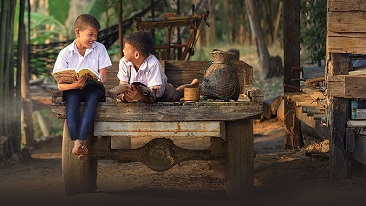

How would your loved ones carry on if something unfortunate befall you? How will they maintain the lifestyle they are accustomed to and cover daily expenses or future education needs?

In a life full of uncertainties, forward-thinking and building a legacy prepare you and your family for a fulfilling future.

PruBSN WarisanGold, the takaful legacy plan that thinks ahead for you and help you attain peace of mind, ensures your loved ones are financially secure if the unexpected happens to you or during your absence.

PruBSN WarisanGold offers high life protection starting from RM350,000* and an auto-increasing coverage amount that grows with you. It also provides accidental death coverage of up to 600% of the Basic Sum Covered** and immediate financial assistance such as Khairat Benefit and Badal Hajj Benefit. The plan comes with special benefits to boost legacy values over the years as well as the auto extension of coverage up to age 100.

Moreover, PruBSN WarisanGold gives you the flexibility to choose your coverage amount, coverage terms, contribution payment terms and customisation with the optional add on benefits to meet different protection needs.

With the Charity Option under PruBSN WarisanGold, you can leave a legacy to your family while giving back to the community.

Get peace of mind with PruBSN WarisanGold - the most comprehensive Takaful legacy solution!

Key product benefits

Note:

*For child, coverage starting from RM250,000.

**Based on total benefits payable for death benefit and accidental death benefit (where applicable).

![]()

Family is priority

When an unfortunate event occurs, you can count on us to help your family in navigating through the tough times with a hassle-free procedure.

|

Build the legacy of love |

In life is full of uncertainties, a legacy plan thinks ahead for you. Come what may, live worry-free knowing that your family's needs are catered to, and the future is secure. |

|

Giving back to the community |

When safeguarding the future of your loved ones, you can also fulfil your saham akhirat with the charitable donation via Ihsan rider and Charity Option, leaving a legacy beyond your family. |

Product details

Coverage and Payment Terms

|

Contribution Term |

5, 10, 20 years or throughout the certificate term |

|

Minimum Monthly Contribution |

Minimum monthly contribution of RM100 for adult and RM50 for child. The contribution is based on your selection of sum covered, contribution term and contribution frequency. Contribution rate varies according to age, gender, smoking status, occupational class, health condition, contribution term and expiry age |

|

Eligibility Age |

1 to 70 age next birthday Notes: |

|

Coverage Expiry |

20 years or expiry age of 70, 80, 90 or 100 |

|

Minimum Sum Covered |

Adult Child |

Features

High Protection

Death and Total and Permanent Disability (TPD) coverage starting from RM350,000 or coverage amount starting from RM250,000 for a child

Accidental Death Coverage of up to 600% of the Basic Sum Covered*

On top of the Death Benefit, additional benefit up to 500% of Basic Sum Covered is payable in the event of death caused by an accident

*Based on total benefits payable for death benefit and accidental death benefit (where applicable).

Special Benefits to Boost Your Legacy Values

Protection Enhancer provides auto increasing coverage up to 15%, and Legacy Booster along with Legacy Bonus maximise your legacy values over the years

Immediate Financial Assistance

Khairat Benefit of RM3,000 and Badal Hajj Benefit of RM3,000

Flexible and Customisable

Various options on coverage amount, coverage terms, contribution payment terms and customisable with optional benefits

Investment opportunity

You can choose from 10 investment-linked funds that fit your risk appetite to increase your cash value with potential upside returns via Takaful Saver or Takaful Saver Kid rider

Auto Extension of Coverage up to Age 100

The coverage will be extended up to age 100*, subject to additional contribution required.

*The coverage will continue as long as there is sufficient cash value for the deduction of Tabarru` and other charges up to age 100 or to each benefit's maximum coverage term, whichever is earlier. Additional contribution may be required to ensure sufficient cash value until end of extended period.

Hassle Free Sign-up

Basic Sum Covered of up to RM4 million, depending on entry age, without undergoing medical examination

Charity Options

- Channel a portion of your death benefit for Sadaqah or Wakaf option

- Make regular charitable donations via Ihsan rider

Benefits

|

Maturity Benefit |

The value of all units in Protection Unit Account (PUA) and Investment Unit Account (IUA), if any. |

|

Death Benefit |

The higher of: |

|

Total and Permanent Disability (TPD) Benefit |

The higher of: |

|

Attachable Riders |

Hajj Umrah Protector |

Tax Exemption

For PruBSN WarisanGold, you may claim relevant insurance tax relief subject to the terms and conditions of the Inland Revenue Board of Malaysia.

Important Note

-

The above is only a brief description of our plan. For full details of the terms and conditions, please refer to your Certificate Document, servicing agent or contact our Customer Service Centre at +603 2775 7188 or customer@prubsn.com.my.

-

Age stated above refers to the Age of your next birthday.

Get more info here

Strengthen your plan with add-ons

Understanding riders

What is a rider?

A rider is a product which adds benefits to your basic takaful plan. Attaching a rider to your basic plan provides you with options such as additional coverage so you can customise the plan to suit your own needs.