PruBSN Damai

Get covered up till 100 years of age for death, total and permanent disability, medical and hospitalisation, critical illnesses, accidents and more, with this Shariah-compliant takaful plan.

For an exclusively tailored packaged designed for Generation Z, kindly click PruBSN DamaiGenZ.

Reasons to consider PruBSN Damai

No one knows when an accident or illness will strike. And with healthcare becoming more expensive, it pays to be prepared for the unexpected.

PruBSN Damai can be your shield against a potential financial crisis, should the unfortunate happen.

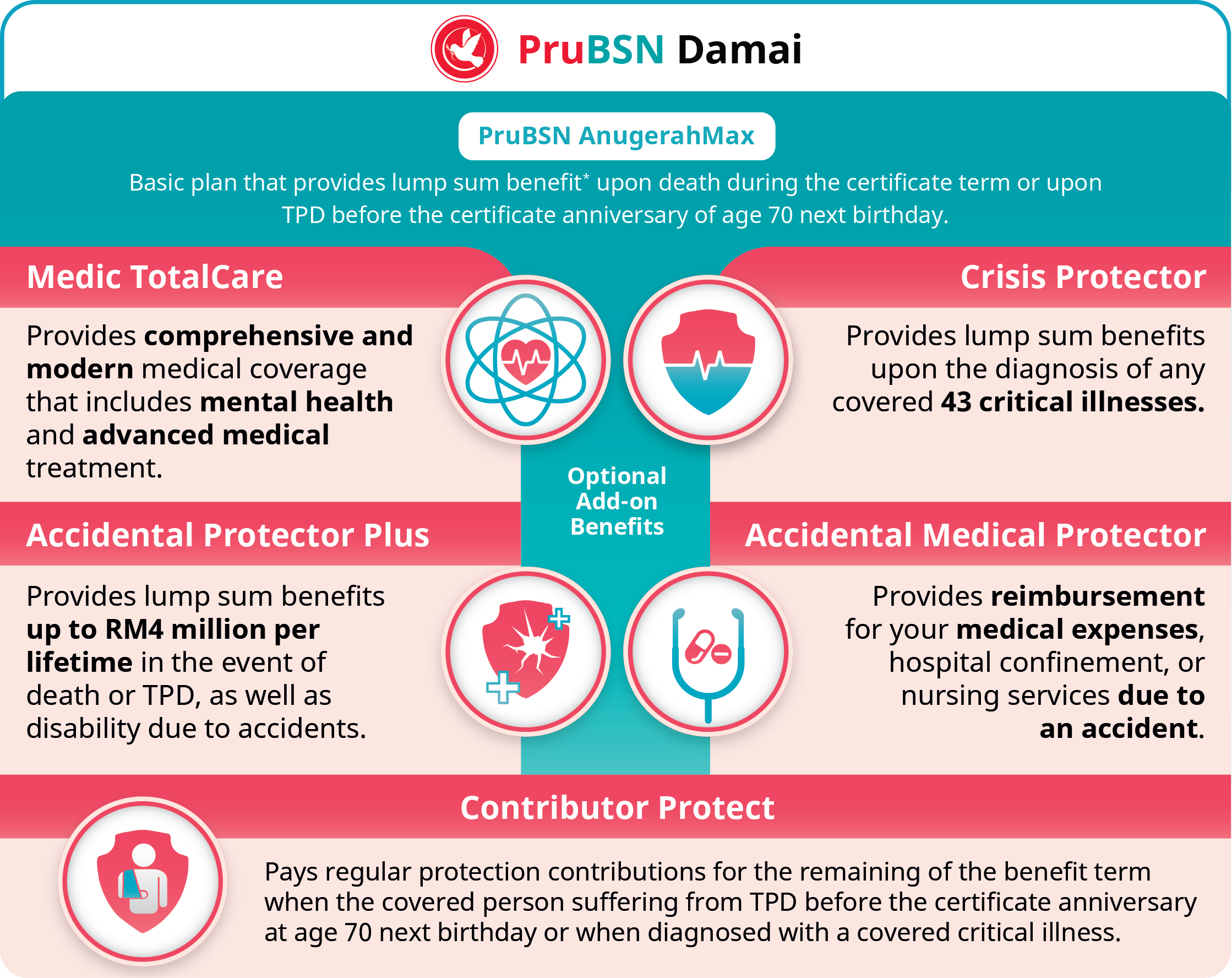

This health protection solution package consists of PruBSN AnugerahMax, a regular contribution family takaful plan that comes with Medic TotalCare, along with other riders and various add-on benefits, giving you flexibility to customise your coverage according to your needs and budget.

Among others, you will get extensive cancer coverage via Medic TotalCare, including additional annual limits and a high lifetime limit for outpatient cancer treatments.

Medic TotalCare also provides an additional limit on top of your annual limit for advanced medical treatments. And with increasing demand for mental health care, you will also have support for mental health treatments, with coverage for eight major mental disorder conditions for both inpatient and outpatient psychiatric treatments.

Don’t leave your health and financial security to chance. Secure the income protection you and your family deserve, for total peace of mind.

Key product benefits

Protected from medical expenses and critical illness.

Customise your plan to protect yourself from the sudden, hefty medical bill of different treatments and overcome your worries on other life uncertainties.

|

Medic TotalCare |

Provides a wide range of hospitalisation and medical treatment coverage to take care of your healthcare needs, including extensive cancer coverage, advanced medical treatment, and mental health care, as well as various outpatient treatment benefits and other unique value-added benefits. |

|

Crisis Protector |

Offers extra protection so you could prepare your fight against critical illness as soon as you're diagnosed. |

|

Accidental Medical Protector |

Helps you to deal with the heavy medical expenses that come after an accident. |

Product details

Coverage and Payment Terms

|

Contribution Term |

Throughout the coverage term |

|

Minimum Monthly Contribution |

RM50 |

|

Eligibility Age |

1 to 70 (age next birthday). Note: For coverage term of 10 years or expiry age 70, the maximum entry age is 60 years old. For coverage term of 20 years, the maximum entry age is 50 years old. |

|

Expiry Age |

Up to 100 years old |

|

Minimum Sum Covered |

RM10,000 |

Features

Customisable Protection Plan

Attach your preferred riders that suit your needs for a comprehensive coverage.

Comprehensive Medical Coverage

Cover various medical and hospitalisation benefits, with flexibility to choose on the types of room and board, the co-payment options and contribution options to suit your individual needs and affordability.

Recommended Add-on Benefits

Here is an overview of the recommended package solution for PruBSN Damai.

Benefits

|

Maturity Benefit |

Remaining balance from Individual Special Account (ISA). |

|

Death Benefit |

Higher of:

|

|

Total and Permanent Disability (TPD) Benefit |

Sum At Risk. Note: The sum at risk is the amount in which the basic sum covered exceeds your Individual Special Account (ISA) balance. If there is no excess sum covered over your ISA balance, the sum at risk is therefore zero. TPD coverage is up to age 70 and subject to a maximum of RM4 million per person covered. |

|

Attachable Riders |

Crisis Shield |

|

Medic TotalCare |

This Shariah-compliant takaful medical rider provides a wide range of hospitalisation and medical treatment benefits for your modern healthcare needs, including extensive cancer coverage, advanced medical treatments, mental health care, as well as various outpatient treatments and other unique value-added benefits. |

Tax Exemption

Up to RM6,000 under Life Insurance and EPF, subject to terms and conditions of Inland Revenue Board (IRB).

Important Notes

-

The above is only a brief description of our riders. For full details of the terms and conditions, please refer to your Certificate Document, servicing agent or contact our Customer Service Centre at +603 2775 7188 or customer@prubsn.com.my.

-

Age stated above refers to the age of your next birthday.

Get more info here

Strengthen your plan with add-ons

Understanding riders

What is a rider?

A rider is a product which adds benefits to your basic takaful plan. Attaching a rider to your basic plan provides you with options such as additional coverage so you can customise the plan to suit your own needs.

Prefer to speak to us?

Customer Service Center

Tel : (+603) 2775 7188

Email : customer@prubsn.com.my

Monday - Friday: 8.30am to 5.15pm

Saturday, Sunday & Public Holiday: Closed

Address : Level 13, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia